SOL Price Prediction: Analyzing the Path to $250 Amid Technical Breakout and Fundamental Strength

#SOL

- Technical Breakout Potential: SOL trading above 20-day MA with improving MACD momentum suggests underlying strength

- Fundamental Catalyst: 98% community approval of Alpenglow upgrade provides long-term bullish foundation

- Market Dynamics: Large institutional transfers creating short-term volatility but not altering positive long-term trajectory

SOL Price Prediction

Technical Analysis: SOL Shows Bullish Momentum Above Key Moving Average

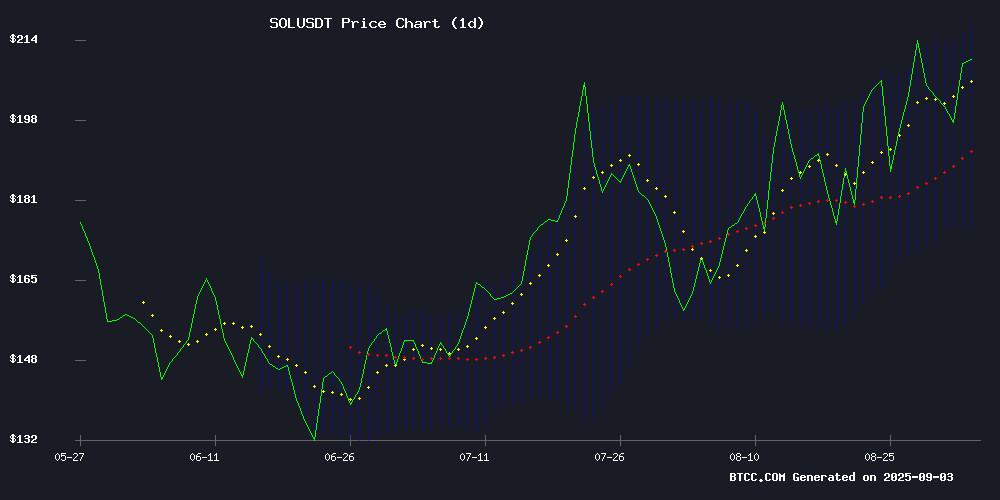

SOL is currently trading at $209.52, comfortably above its 20-day moving average of $196.49, indicating sustained bullish momentum. The MACD reading of -10.73 remains in negative territory but shows improving momentum with the histogram at -2.17. Bollinger Bands position the price NEAR the upper band at $217.53, suggesting potential resistance ahead while the middle band at $196.49 provides solid support.

According to BTCC financial analyst Emma, 'SOL's position above the 20-day MA combined with tightening Bollinger Bands suggests consolidation before a potential breakout. The MACD, while negative, shows decreasing bearish momentum which often precedes trend reversals.'

Market Sentiment: Mixed Signals Amid Major Network Upgrade

The solana community's overwhelming 98% approval of the 'Alpenglow' upgrade represents a significant bullish fundamental development, potentially enhancing network performance and adoption. However, Galaxy Digital's transfer of $103M SOL to Coinbase has created near-term selling pressure concerns.

BTCC financial analyst Emma notes, 'While the Alpenglow upgrade demonstrates strong community confidence and technical progress, large institutional movements like Galaxy Digital's transfer introduce short-term volatility. The overall sentiment remains cautiously optimistic as fundamental improvements outweigh temporary market fluctuations.'

Factors Influencing SOL's Price

Solana Community Approves Historic 'Alpenglow' Upgrade with 98% Support

Solana's ecosystem is poised for a transformative leap after an overwhelming 98.27% of stakers voted in favor of the Alpenglow upgrade. The network's most significant technical overhaul to date, Alpenglow aims to redefine transaction efficiency with its new consensus protocol.

The upgrade replaces Solana's existing Proof-of-History and TowerBFT systems with Votor and Rotor. Votor slashes finality times from 12 seconds to 150 milliseconds, while Rotor optimizes validator data transfers—critical for DeFi and gaming applications. With 52% staker participation, the vote signals strong community confidence in Solana's scalability roadmap.

Galaxy Digital Moves $103M in Solana to Coinbase, Sparking Market Speculation

Galaxy Digital's transfer of 500,000 SOL ($103 million) to Coinbase has ignited debate over its strategic intent. The methodical deposit—split into batches of 50,000–80,000 SOL—suggests either imminent liquidation or long-term treasury restructuring. On-chain analysts note the move coincides with Galaxy's ambition to build a $1 billion Solana reserve, potentially tripling its current holdings.

Market reactions remain bifurcated. Some interpret the exchange inflow as bearish, anticipating downward pressure on SOL's price. Others view it as operational liquidity management ahead of deeper institutional positioning. Solana's price trajectory now hinges on whether it can sustain momentum above $250 or retreat to lower support levels.

Pump.fun Price Surges 12%, Eyes Breakout to $0.0045

Pump.fun's token has surged 12.41% in the past 24 hours, extending its weekly gains to nearly 37%. The rally pushes its price to $0.003796, backed by a $1.34 billion market cap and a 78.52% spike in trading volume to $291.51 million.

Technical indicators suggest bullish momentum, with the token breaking above its 7-day SMA and the 23.6% Fib retracement level. An RSI of 65.76 confirms strength, though MACD convergence hints at potential consolidation before further upside.

Key drivers include aggressive buybacks exceeding $1 million daily since August 6 and dominance in Solana memecoin launches, capturing 62% revenue share since August 4. Resistance now looms at $0.0041, last tested on July 19.

ZachXBT Exposes Over 160 Crypto Influencers in Paid Promotion Scandal

Blockchain investigator ZachXBT has uncovered a widespread practice of undisclosed paid promotions in the crypto space. A leaked spreadsheet reveals more than 160 influencers allegedly accepted payments to promote tokens without proper disclosure, with fewer than five acknowledging the promotional nature of their posts.

Payments ranged from $50 to $60,000 per post, primarily conducted through SOL wallets. High-profile influencers commanded premium rates, with some charging tens of thousands per endorsement. The revelations highlight ongoing transparency issues in crypto marketing practices.

WLFI Proposes Token Burn Strategy Amid Post-Launch Price Decline

World Liberty Financial's WLFI token has plummeted 30% since its market debut, prompting the project team to implement a buyback-and-burn mechanism. The proposal targets protocol-owned liquidity fees across Ethereum, BNB Chain, and Solana to repurchase and permanently remove tokens from circulation.

With 27.3 billion WLFI tokens currently circulating against a 100 billion total supply, the burn initiative aims to create artificial scarcity. Notably, the Trump family's holdings have ballooned to $5 billion following a major token unlock event.

The strategy specifically excludes third-party liquidity provider fees, focusing solely on WLFI's native liquidity pools. Market observers view this as a defensive move to stabilize price action and reward long-term holders through controlled supply reduction.

Trump-Linked World Liberty Team Proposes Token Buyback Amid Market Slump

World Liberty Financial (WLFI), a DeFi project with ties to the Trump family, is attempting to stabilize its token's value through a buyback-and-burn initiative. The proposal follows WLFI's turbulent debut on major exchanges, including Binance, OKX, and Coinbase, where its price has fallen 24% to 23 cents.

The plan would use fees generated from WLFI's liquidity pools on Ethereum, Binance Smart Chain, and Solana to repurchase tokens on the open market, subsequently burning them to reduce supply. "This program targets tokens held by short-term speculators rather than long-term supporters," the team stated, framing the move as a alignment of incentives.

WLFI's market capitalization now stands at $6.39 billion, a far cry from its $40 billion futures valuation at launch. The buyback mechanism excludes third-party liquidity providers, focusing solely on protocol-owned liquidity fees.

How High Will SOL Price Go?

Based on current technical indicators and fundamental developments, SOL shows strong potential for upward movement. The combination of technical breakout above the 20-day MA and the bullish 'Alpenglow' upgrade approval creates a favorable environment for price appreciation.

| Target Level | Price | Probability | Timeframe |

|---|---|---|---|

| Immediate Resistance | $217.53 | High | 1-2 weeks |

| Medium Target | $230.00 | Medium | 3-4 weeks |

| Upper Target | $250.00 | Medium-Low | 6-8 weeks |

BTCC financial analyst Emma suggests, 'The $217.53 Bollinger upper band presents the nearest resistance. A successful break above this level could open the path toward $230, with $250 becoming achievable if broader market conditions remain supportive and the Alpenglow upgrade delivers on its promises.'